amilyar calculator|Your Guide to Real Property Tax or Amilyar in the : Tagatay How much is Amilyar in the Philippines? To calculate the amilyar, the assessed value of the property is multiplied by the applicable tax rate, which varies depending on the type . 40 video found with crizen nicole . Watch crizen nicole viral videos, nude photos, sex scandals, and other leaked sexy content. If you have any requests, concerns, or suggestions related to crizen nicole , you can leave your message in the comment section found at the bottom part of every post.

PH0 · Your Guide to Real Property Tax or Amilyar in the

PH1 · Understanding Amilyar: A Guide to Real Property Taxes in the

PH2 · Real Property Tax in the Philippines: A Property Owner’s Guide

PH3 · Q&A: How do you compute for the real property tax of a

PH4 · How to Compute Real Property Tax In The Philippines

PH5 · Everything you need to know about Amilyar

PH6 · CAO

PH7 · Amilyar: A Guide to Real Property Tax, Deadlines, and Payments

PH8 · Amilyar in the Philippines: A Simple Guide to Real Property Taxes

PH9 · Amilyar in the Philippines: A Simple Guide to Real

PH10 · Amilyar (Real Property Tax): Comprehensive Guide

The Psychometrician Board Exam Result August 2024 is expected to be released on August 14-19, 2024, that is according to PRC Resolution No. 1728 series of 2023, entitled “Schedule of the Licensure Exam for the Year 2024” .

amilyar calculator*******Calculate your Tax Here. Real Property Tax Calculator. TIPS ON HOW TO USE REAL PROPERTY TAX CALCULATOR. 1. Select your subclassification. "RA" stands for .What is Real Property Taxes or “Amilyar” in the Philippines? Are There Types of Properties Exempted from Real Estate Taxes? How Do You Compute Real Property Taxes? How Much is Real Property Tax or Amilyar in the Philippines? As stated in the Local Government Code of 1991, amilyar computation is based on the following .

Sample computation. To compute for RPT, the RPT rate for the property is multiplied by the property’s assessed value (land plus building and other structures). The .How much is Amilyar in the Philippines? To calculate the amilyar, the assessed value of the property is multiplied by the applicable tax rate, which varies depending on the type .amilyar calculator Your Guide to Real Property Tax or Amilyar in the How much is Amilyar in the Philippines? To calculate the amilyar, the assessed value of the property is multiplied by the applicable tax rate, which varies depending on the type .

What is the cost of Amilyar in the Philippines? Calculating the amilyar entails adhering to this formula: Real Property Tax equals Rate multiplied by Assessed . Amilyar is often used by Filipinos to refer to real property tax. How is Amilyar calculated? Amilyar or real property tax is computed by using the formula: REAL .Your Guide to Real Property Tax or Amilyar in the Amilyar is the colloquial term for the Filipino word “Amilyaramiyento” or real property tax, derived from the Spanish word “Amillaramiento”. While this tax is one of .

Real Property Tax (RPT) or “Amilyar” in the Philippines is a tax that owners of real property need to pay every year. If you don’t pay, the local government unit (LGU) can include your property in their next tax .REAL PROPERTY. PAYMENT OF REAL PROPERTY TAX. Pursuant to the provisions of Section Nos. 233, 235 and 250 of Republic Act 7160, otherwise known as the Local Government Code of 1991, as adopted under Ordinance No. 08-3233 dated September 19, 2008, of Cavite City, the payment of Basic Tax at the rate of 2% and 1% additional tax .Real Estate Tax = Real Estate Rate x Assessed Value of the Property. Taking the same example above: Real Property Tax: Total Assessed Value (Php 1,200,000.00) x Metro Manila Real Estate Tax Rate (2%) = Php .

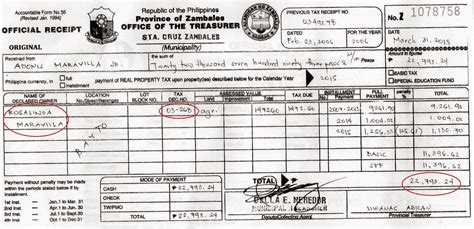

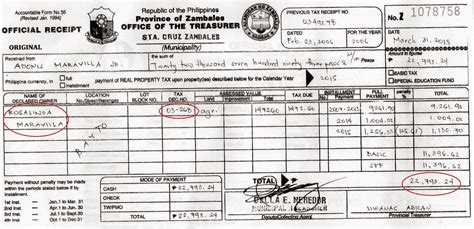

Proceed to the billing section and pay your due amount after calculating the exact amount. As evidence of your payment, obtain the receipt. Understanding amilyar and its associated taxes is an important responsibility for all property owners in the Philippines. By staying informed about the assessed value of their property, the applicable tax .

September 30. December 31. Beat the rush, pay early. We advise our taxpayers to pay their taxes at the earliest possible time, to avoid the inconveniences of long queues and congestion. Real property taxpayers who choose to pay on a quarterly basis can still pay on or before the dates stated below: March 31. June 30.

Metro Manila - 2% of the assessed value. To calculate your real property tax, you can use the following formula: Real Property Tax = Rate x Assessed Value. For instance, if your property in Metro Manila has an assessed value of ₱1,000,000, your real property tax would be ₱1,000,000 x 2% = ₱20,000. However, if your property of the same . Calculate Your Tax: Use the formula by multiplying the Real Estate Rate by the Assessed Value of the real property. To illustrate, if your property is in Metro Manila with an assessed value of PHP 1,000,000, your calculation would be 0.02 (Real Estate Rate) x 1,000,000 (Assessed Value), resulting in a tax due of PHP 20,000 annually. The amount of your amelyar or real property tax depends on the assessment of your property by the assessors office. It is advisable to pay for your amelyar every beginning of the year because they usually offer at least 20% discount. But if a year’s tax is huge for your budget you have a choice to pay it quarterly.This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. Using the values from the example above, if the new car was purchased in a state without a sales tax reduction for trade-ins, the sales tax would be: $50,000 × 8% = $4,000. A: There are consequences in the event that you fail to pay the RPT or amilyar of your property, the most immediate of which is interest accruing on top of the unpaid taxes. According to Section 255 of the Local Government Code of the Philippines, failing to pay RPT “shall subject the taxpayer to the payment of interest at the rate of two . Your tax rate hinges on whether your property is located within or beyond Metro Manila. – Within Metro Manila, your amilyar equals 2% of your property’s assessed value. To illustrate: – Given an assessed value of P3,000,000.00, your amilyar calculation would be: P3,000,000.00 x 2% = P60,000.00. – Outside Metro Manila, your amilyar .15. $643.13. $19,609.43. $-0.00. While the Amortization Calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for common amortization calculations. Mortgage Calculator. Auto Loan Calculator.pay calculator. Use this calculator to quickly estimate how much tax you will need to pay on your income. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Use the 'Tax Year' drop down to preview the 2024-25 tax rate changes proposed in January 2024. Once processed, you will get your receipt and the RPT Order of Payment. Proceed to the City Treasurer. They are located at the end of the hall and then in the room to your right. Give them the documents you received from the Assessor in exchange for a Statement of Account. Pay at the cashiers in Windows 9 and 10 outside.BMI Prime: 0.92. Ponderal Index: 12.9 kg/m 3. The Body Mass Index (BMI) Calculator can be used to calculate BMI value and corresponding weight status while taking age into consideration. Use the "Metric Units" tab for the International System of Units or the "Other Units" tab to convert units into either US or metric units.Tax Clearance from Municipal or Provincial Treasurer’s Office. Tax Declaration (Certified Xerox or Owner’s Copy) Transfer Certificate of Title. Real Property Payment. Copy of previous official receipt. Certified xerox or owner’s copy of tax declaration. RPT Tax Clearance. Original Copy of Official Receipt.amilyar calculator Nov. 11, 2025. Thanksgiving. Nov. 27, 2025. Christmas. Dec. 25, 2025. This free date calculator computes the difference between two dates. It can also add to or subtract from a date. Both can deal with business days and holidays.There are now different online tax calculators in the Philippines. You must always be sure to go with the best, efficient, updated, and legitimate online tax calculator program. Taxumo is the best option for digital tax filing in the Philippines. It is the # 1 online tax calculator in the Philippines. It is an ideal choice for small-scale . QCitizens, magbayad nang maaga para maka-DISKWENTO sa inyong REAL PROPERTY TAX (amilyar)! ADVANCE PAYMENT: Mananatili pa rin ang 20% discount kung ang 2024 RPT ay mababayaran nang buo hanggang December 31, 2023. PROMPT PAYMENT: 10% discount naman kung ang full payment ng 2024 RPT ay .

Watch Emma Dingle porn videos for free on Pornhub Page 4. Discover the growing collection of high quality Emma Dingle XXX movies and clips. No other sex tube is more popular and features more Emma Dingle scenes than Pornhub! Watch our impressive selection of porn videos in HD quality on any device you own.

amilyar calculator|Your Guide to Real Property Tax or Amilyar in the